Time to invest in CGT: Its Benefits for Pharma

6 years ago

By Bryan

6 years ago

By Bryan

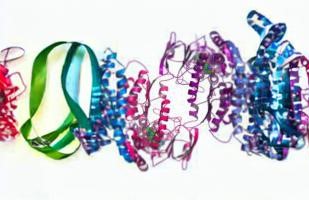

The concept of cell and gene therapy (CGT), wherein scientists and healthcare experts adapt cells and genes to treat illnesses, is nothing new in the life science space. Even the relatively new CRISPR has transformed into a household buzzword over the last few years. Recently, big pharma has started to invest heavily in the area – though some companies more than others. But with competition to find the next Kymriah heating up, the window is closing on maximising CGT’s potential in a fierce market.

The Potential of Cell and Gene Therapies

Until very recently, cell and gene treatments saw limited uptake in the pharmaceuticals industry, due to their relatively new and untested status. But with greater coverage and increased research around the world, CGT has quickly becoming one of the more exciting fields pharma can invest in. CAR-T therapies have already seen some big names, most notably Novartis and Gilead, finding success at the forefront of the technology’s usage with the approval of both Kymriah and Yescarta.

Most large pharma companies are now investing in CGT: Novartis acquired commercial gene therapy company AveXis for $8.7 billion last year, while gene therapy expert Spark Therapeutics was bought up by Roche for around half that earlier in 2019. Global investment in cell therapies rose by 64% in 2018 compared to the previous year.

Despite this, investment in CGT is not evenly distributed across the board. Roche has shown reduced interest in cell and gene therapy compared with its contemporaries, though it has recently begun working with T-cell engaging bispecific antibodies. Eli Lilly, too, has seen limited takeup of CGT innovation, avoiding CAR-T therapies and only last year announcing a collaboration with Sigilon to develop encapsulated cell therapies at all.

The benefits of investing in the promising CGT field are numerous and evident, shown most clearly in the extreme sector takeup over the last few years: the area was valued at $6 billion in 2017, with a projection for it to exceed $35 billion by 2026. But the reasons for delay in investment, while more subtle, do still exist: and it is worth noting the main reasons for some companies’ reticence to invest in CGT even as the need to do so becomes more urgent than ever.

Challenges

Part of the reason for the hesitancy expressed by companies with a slow CGT takeup is the number of unaddressed issues the sector faces at present. While CGTs have only grown in safety and efficacy as demonstrated by both lab and clinical trials, obstacles remain that limit takeup from some pharma giants.

MANUFACTURING ISSUES – Regulatory requirements specify that cell and gene therapies do not materially change through the manufacturing process. However, due to the stringent commercial incentives to optimise manufacturing processes and evolve constantly through to commercial launch, companies must maintain a careful balance between state-of-the-art processes and ones which do not change the product in any meaningful way.

TRANSPORTATION DIFFICULTIES – Any biological material is difficult both to grow and transport: a reliable manufacturing system is key to effective management of CGT.

FEARS OVER SAFETY – Proventa recently covered Google’s ban on experimental CGT advertisements on its sites, a story that represented a number of fears in the professional world over the safety and utility of the therapies. For the most part, this fear is entirely unfounded:

NEED FOR SUCCESSFUL ASSAYS – Meeting regulatory standards for safety and efficacy is vital in any pharmaceutical area, but creating a specific mechanism of action for CGT is difficult. Even when this is done, a further challenge then exists of showing the assay actually measures for the critical specifications set out. Often a company is left with no choice but to develop its own assays or assay panels due to a lack of suitable commercial choice.

Of course, these are only high-level solutions to problems preventing companies from investing. To fully understand the issue and receive expert insight into solving key CGT challenges and better integrating and implementing CGT processes within a business, come to Proventa’s Cell & Gene Therapy Strategy Meeting 2019, hosted on 8th October in Zurich, Switzerland.

Talk topics include optimising CAR-T cell therapies, adopting CRISPR to modulate immunosuppressive pathways in CAR-T products, the challenge of clinical manufacture of modified cells and avoiding toxicity when administering large drug doses.

The Need to Invest

However, while these challenges do exist and are continuing to act as a brake on pharma investment in CGT, solutions are already beginning to appear to solve the worst such issues.

For example, truth that almost every expert shares is that innovation in CGT is coming largely from startups and smaller companies. This is certainly the case where the manufacturing bottleneck is concerned, with companies such as Oxford Genetics and TreeFrog Therapeutics creating an improved system for culturing and transporting stem cells to ensure maximum growth, and devising automation technologies to improve the logistical aspect of the manufacturing supply chain.

The number of companies dedicating effort to creating solutions for CGT, and certainly the number of pharma giants investing huge amounts in the area, both show that now is the time to be investing.

More than $550 million was raised by companies working with CAR-T projects between 2011 and 2016, with $2.2 billion in investment raised by the ten biggest cancer immunotherapy startups alone. Between June 2013 and May 2015 the six largest companies working with CAR-T were valued collectively at $962 million at IPO; now, they are worth more than $30 billion in total.

The CGT sector has reached the point of rapid expansion, with both the price of innovative, inventive startups skyrocketing and the hunger of big pharma for CGT portfolios growing by the day. The time is now to invest in CGT: a later investment could well be too late.

Joshua Neil

Editor, Proventa International

To ensure you remain up-to-date on the latest in biomanufacturing, sign up for Proventa International’s Cell & Gene Therapy Strategy Meeting 2019, hosted on 8th October in Zurich, Switzerland.

DeepMind’s AI Predicts Structures for More Than 350,000 Proteins

In 2003, researchers sequenced approximately 92% of the human genome, a huge achievement and very recently researchers have completed the entire process. Now, the latest innovation in AI technology has predicted the structure of nearly the entire human proteome. The...

4 years agoDeepMind’s AI Predicts Structures for More Than 350,000 Proteins

In 2003, researchers sequenced approximately 92% of the human genome, a huge achievement and very recently researchers have completed the entire process. Now, the latest innovation in AI technology has predicted the structure of nearly the entire human proteome. The...

4 years ago

COVID-19 Booster Controversy: Disputes Across the Pharma Industry

Despite almost two thirds of the adult population in the UK having been vaccinated, cases are on the rise, which appear to be associated with the highly-transmissible delta variant of COVID-19. According to The European Centre for Disease Prevention and Control,...

4 years agoCOVID-19 Booster Controversy: Disputes Across the Pharma Industry

Despite almost two thirds of the adult population in the UK having been vaccinated, cases are on the rise, which appear to be associated with the highly-transmissible delta variant of COVID-19. According to The European Centre for Disease Prevention and Control,...

4 years ago

COVID’s Impact on Innovations in Regulatory Affairs

While the impact of COVID-19 was significant in every area of the pharmaceutical sector, some of the most pandemic’s most overlooked impacts were within the regulatory space. From study design to submissions, the virus affected every aspect of drug regulation,...

4 years agoCOVID’s Impact on Innovations in Regulatory Affairs

While the impact of COVID-19 was significant in every area of the pharmaceutical sector, some of the most pandemic’s most overlooked impacts were within the regulatory space. From study design to submissions, the virus affected every aspect of drug regulation,...

4 years ago